Over 20 years later, we still follow a fiduciary standard with significant resources at hand, and we’ve honed our services to cater to those with significant wealth who are preparing for or living in retirement. Holding several industry designations, Jon attributes those accolades to the efforts of his team and their unique balance of down-to-earth personal guidance and industry-recognized financial expertise.

Trust and transparency matter more than ever, so we’re proud to offer clients an open and approachable environment through which they can access sophisticated financial solutions.

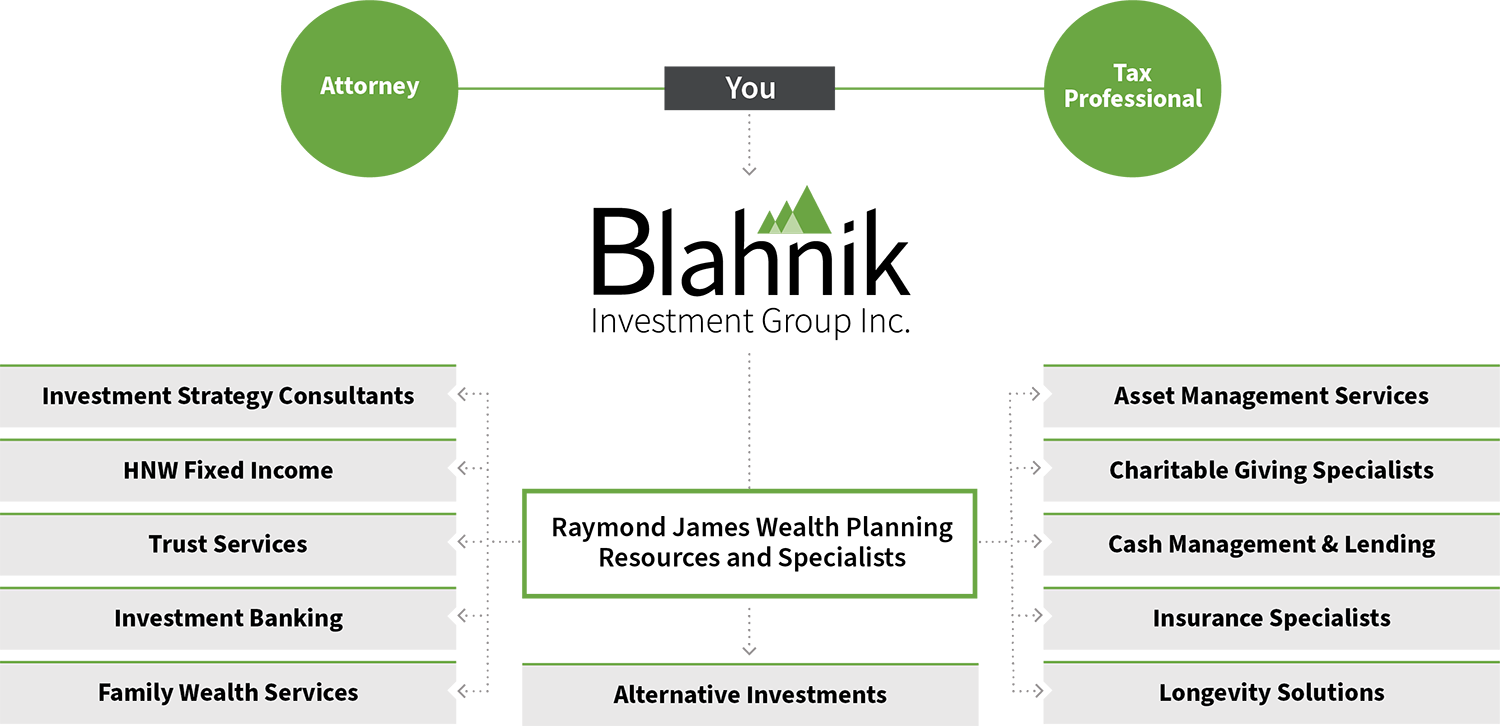

Getting to know us also means getting to know the firm we are associated with. Raymond James Financial provides the resources we need to deliver comprehensive financial guidance. Here are a few of the advantages of this partnership:

We have access to one of the industry’s widest platforms of investment products, account types and insurance carriers, but without the corporate restrictions and incentives that can lead to biased advice. Raymond James is one of the largest independent firms in the country and strives to represent the premier alternative to Wall Street.

With total assets under administration exceeding $896 billion and offices around the world, Raymond James represents significant size, scale and financial strength. Combined with the firm’s membership in the Securities Investor Protection Corporation (SIPC) and the excess SIPC coverage they have obtained for their entire network, this partnership enables us to offer our clients exceptional protection and security.

Raymond James Financial is a publicly traded company that provides us with access to resources like investment brokerage, insurance solutions, trust services, and private and commercial banking. They also provide a rigorous and proactive due diligence process, an essential feature of our custom investing approach. View the full due diligence process here.

Raymond James was built with a focus on serving individuals and families. Founded in 1962 to provide sound investment guidance for individual clients by examining all aspects of their financial needs, they were the first financial services firm to create a Client Bill of Rights and Responsibilities in 1994. This has since been recognized as industry best practice and has been emulated by many peer firms.

“Our independence, coupled with our access to Raymond James resources, is a crucial part of what makes our services valuable. Our clients have the advantage of getting objective advice from a dedicated team, with the support of one of the industry's leading financial institutions.”

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Jon Blahnik founded Blahnik Investment Group in 2002, as an independent practice associated with Raymond James. Since 1996, he has been guiding clients through financial decisions using a goal-oriented holistic planning process and a risk-conscious approach to investing.

Jon identifies strongly with the author, economist, investor and scholar Benjamin Graham’s assertion “the best way to measure your investing success is not by whether you’re beating the market, but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.” His primarily dividend-focused investing approach has proved particularly relevant for his client base of families, business owners, and retirees.

Since 2002, when he established the first Door County branch associated with Raymond James, Jon has been building a multi-faceted team and a network of resources through which his clients can gain comprehensive wealth services that are largely unavailable in the area. In the last several years Jon has proactively reduced the size and scope of his practice to focus solely on those clients and segments that he and his staff feel they can best serve and add value with their custom resources and processes.

After serving as Branch Manager for 18 years, in late 2020 Jon signed a succession agreement with, and then merged his practice with, a Green Bay-based Raymond James office to reduce his management responsibilities in an ongoing team effort to focus on clients.

Jon holds Series 7, 24, 31, 51, 63 and 65 licenses, and Wisconsin insurance licenses, and has earned the Accredited Asset Management Specialist℠ and Accredited Wealth Management Advisor℠ designations from the College for Financial Planning over the course of his career. As an acknowledgement of his dedication and passion for helping clients with their financial goals, Jon has been recognized by Raymond James management via their Executive Council or Leaders Council* every year since 2006.

*Membership is based on prior fiscal year production. Re-qualification is required annually. The ranking may not be representative of any one client’s experience, is not an endorsement, and is not indicative of an advisor’s future performance. No fee is paid in exchange for this award/ranking.

Since 1998, Jack Keller has helped clients manage their wealth through market cycles. He came to Blahnik Investment Group after nine years with UBS Financial Services in downtown Chicago, and seven years with Smith Barney. Prior to his financial services roles, Jack served as Vice President and Controller of a privately held manufacturing company.

Jack has specialized expertise in retirement income planning and total wealth management, with a focus on identifying financial risks in clients’ lives. He is well versed in education funding, structures for charitable giving, and estate planning, and he also serves as the team’s internal insurance specialist. He is FINRA registered and holds Series 7, 24, 63 and 65 securities licenses, as well as licenses for life, long-term care insurance and variable annuities. He earned his certification as a Chartered Retirement Planning Counselor℠ (CRPC®) from the College for Financial Planning in 2012, and holds a Bachelor’s Degree in Business Administration and Finance from the University of Wisconsin (Eau Claire).

Originally from Combined Locks, Wisconsin, Jack and his wife Cathy moved from the southwest suburbs of Chicago to Sturgeon Bay, where they are more welcome as devoted Packer fans. Their grown daughter Christina, also a fan of the green and gold, remains in the Windy City.

Prior to joining Blahnik Investment Group, for almost two decades Barbara excelled in retail banking here in Door County. Starting out as a teller, and over time becoming Branch Manager, and eventually Area Manager, Barbara’s philosophy of meeting clients where they are, learning where they have been and where they want to be, and building a plan to get them there, has been at the heart of helping clients succeed. Her holistic, multi-faceted approach is consistent with the Blahnik Investment Group philosophy, enabling her to seek a new challenge and transition her career while continuing to support her Door County neighbors.

Barbara brings a unique perspective to the finance industry, having earned both a Bachelor's degree from the University of Iowa and a Master's Degree in Human Services from the University of Wisconsin-Stout. She complements her extensive experience in banking with licenses in Life, Health, Disability, and Credit Life and Disability Insurances.

Originally from Iowa, Barbara returned to her family’s roots, settling in Sturgeon Bay in 2005. Being well established and having a deep sense of community, she proudly served as President of both Altrusa of Door County and Destination Sturgeon Bay. She currently serves on the boards of Leadership Door County, Women’s Fund, and Noon Rotary.

When not working, Barbara enjoys spending time with family. She especially enjoys traveling, boating on the beautiful waters of Door County, and enjoying all that Door County has to offer.